Re-financing Loan

You will gain access to equity in your home for various purposes such as renovation, debts consolidation and education.To help borrowers re-finance residential property or cash equity with Interest Only Payments

Target Client

Borrowers who want to buy a home, pay off existing debts, access their home equity to meet their personal needs.

Advantage

1. Up to 85% LTV

2. Interest Only Payments

Product Features

| Description | 1st Mortgages | 2nd Mortgages |

| Maximum LTV | 75% | 85% |

| Lending Areas | Alberta & Manitoba | Same as 1st Mortgages |

| Minimum Beacon | None | None |

| Max Mortgage | $500,000.00 | $500,000.00 |

| Income | Employment & Stated Income | Employment & Stated Income |

| GDS/ TDS | NONE – deal must make sense | NONE – deal must make sense |

| Purpose | Purchase, Refinance, developments | Purchase, Refinance, developments |

| Term | 1-2 years (closed) | 1-2 years (closed) |

| Interest Rate | 7.99% to 9.99% (case to case basis) | 12.99% to 15.99% (case to case basis) |

| Lender Fee | 3% or MIN $1,000.00 | 3% or MIN $1,000.00 |

| Broker Fee | Broker can decide | 1. Broker can decide 2. Broker Fee can be Topped up upto Max 1% LTV |

| Doc Fee | $550.00 | $550.00 |

| Appraisal | Rq. Appraisal must be ordered from WINmic approved appraisers only | Rq. Appraisal must be ordered from WINmic approved appraisers only |

| Title Insurance | Required | Required |

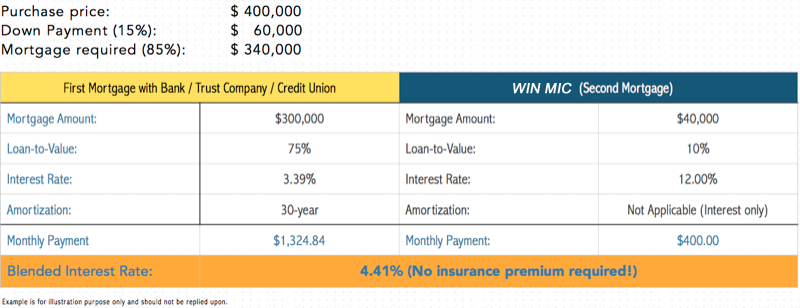

Example