Overview of WINMIC

Higher yields than traditional investment products.Mortgage Investment Corporations were introduced in Canada in 1973 through the Residential Mortgage Financing Act. Owning shares in a mortgage investment corporation enables you to invest in a company which manages a diversified and secured pool of mortgages.

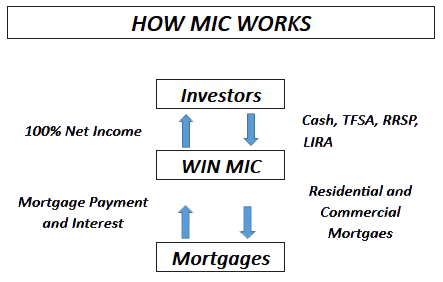

MICs provide opportunities for the retail investors to participate in mortgage lending and real estate investments on much the same lines as mutual funds, which enhance their earnings by leveraging their investment in residential mortgages and enjoying the spread between the interest paid on borrowed funds and the interest charged on mortgages.

Essentially, the MIC allows the retail investors to share in the benefits of the lucrative and relatively secure mortgage business.

Why should you invest with WINMIC ?

Easy to Understand

Simplicity is one of the most popular characteristics of the MIC model. MICs are an easy investment to understand as most investors are familiar with the concept of a mortgage. WIN MIC will provide annual financial statement to keep investors well informed.

Secure by Real Estate

Our mortgage portfolio will consist mainly of residential, commercial as well as Bridge financing loans SECURED by first or second mortgages. Total mortgage amount will not exceed 85% of the most recent valuation of the property.

Accountability

MICs must meet a set of requirements pursuant to section 130.1 of the Income Tax Act. One of the requirements is at every fiscal year audit of a MIC’s annual financial statement must be made by an independent accounting firm. WIN MIC is being audited every year by Magnus CA LLP, an independent accounting firm based in Winnipeg.

Yield

WIN MIC has consistently met the benchmark yield of 6% – 8% annually. We can help you to achieve your retirement and financial goals.